The Goods and Services Tax (GST) is a crucial component of India’s tax system, impacting businesses and individuals alike. To navigate the complexities of GST, it’s essential to comprehend how it’s calculated and how it affects your finances. This article will guide you through calculating GST and introduce you to a helpful tool – the GST calculator.

GST Calculation Basics:

GST is a consumption-based tax levied on the supply of goods and services. It is categorized into Central GST (CGST), State GST (SGST), and Integrated GST (IGST), depending on the transaction’s nature. The GST rate varies depending on the type of product or service, with standard rates, concessional rates, and zero rates being common.

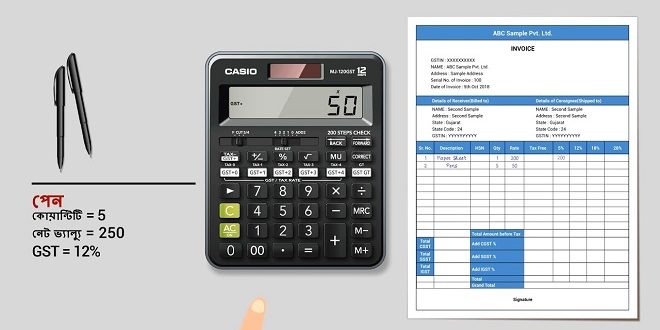

Using the GST Calculator:

Calculating GST manually can be time-consuming and prone to errors. Thankfully, there’s an easy solution – the GST calculator. Here’s how to use it:

Select GST Type: Choose the appropriate GST type – CGST, SGST, or IGST, based on the transaction.

Enter Transaction Value: Input the value of the goods or services for which you want to calculate GST.

Select GST Rate: Choose the applicable GST rate for the product or service.

Calculate GST: Click the ‘Calculate’ button, and the tool will instantly display the GST amount.

Benefits of Using the GST Calculator:

Accuracy: The calculator eliminates calculation errors and ensures you’re charging or paying the correct amount of GST.

Time-saving: It’s a quick and efficient tool, saving you time and effort.

Compliance: Helps you adhere to tax regulations, reducing the risk of penalties or fines.

In conclusion, understanding how to calculate and use a GST calculator is essential for businesses and individuals. It streamlines the process, ensures accuracy, and helps maintain compliance with tax regulations

Isaiminia World Breaking News & Top Stories

Isaiminia World Breaking News & Top Stories