The study of market price fluctuation is known as price action. Price is the source of value for many fundamental and technical analysis tools, so why not study, analyze, and learn from the price itself? Price action traders try to accomplish just that. They feel that the price tells them all they need to know about a specific market. This is what sets price action apart from other trading methods that rely heavily on mathematical indicators. The price and time variables that are clearly represented on a ‘clean’ chart are the two most critical things to consider while trading price movement. Because there are no indications to obscure the price perspective, it is referred to as a clean or naked chart.

Price action transactions also include psychological and behavioral judgments and subsequent actions as determined by the price action trading course:

1) Support and Resistance: Support is a price level at which demand is thought to be strong enough to prevent the price from dropping further. When the price bounces back up off of support, this is referred to as a “floor.” Resistance is the price level at which selling is regarded to be strong enough to prevent the price from rising any higher. When the price swings back down from resistance, it is called a “ceiling.” Support and resistance levels are useful because they may help traders decide when to enter and exit trades.

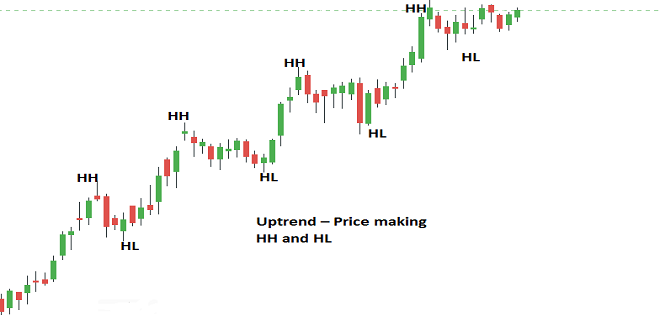

2) Trendlines: Trendlines are basic tools that connect a stock’s high points to indicate the security’s current direction. When looking for channel breakouts and price objectives, many traders utilize trendlines to identify whether a stock is in an uptrend or downturn. If they believe a channel will hold, it makes sense to purchase at the bottom and sell near the top.

3) Chart Formations: There are a variety of chart formations available, including head and shoulders, triangles, wedges, and others. Ahead and shoulders pattern, for example, denotes a modest downward change followed by a more massive rally — imagine W shaped. This might indicate a trend reversal, with the price falling back to test support.

4) Support and Resistance Zones: Resistance is created when a strong move to a new high or low occurs since the prior trading range is no longer viable (overwhelming selling pressure). It becomes support after the old trading range is broken through. The best deals are made during this period of transition when supply and demand are momentarily balanced.

5) Divergence: Some chart patterns, such as head and shoulders, are frequently seen in conjunction with divergence. When an indicator makes a lower high while prices make greater highs (or vice versa), divergence occurs, signaling that there is less purchasing pressure than typical.

6) Fibonacci Retracement: Using Fibonacci retracement levels is a common approach to determine probable price objectives for securities on the move. These are horizontal lines that run along the peaks and valleys of a stock chart that have been broken into parts to illustrate whole number ratios. For different time periods, different retracement levels are employed, but for swing traders, 38.2 percent, 50 percent, and 61.8 percent are common. These levels are based on the fact that financial markets frequently retrace precise percentages following large swings, which means they might serve as ideal entry or exit marks.

7) Opening and Closing Bells: The opening and closing bells are important because they indicate when traders have finished collecting or dispersing shares. If trade was robust throughout the day but quiet at night, it means supply will be constrained in the future.

If trade is weak at the start and high at the end, however, it implies that demand will be robust after hours.

8) Volume: Simply defined, volume refers to the total number of shares traded in a certain time period. Prices are linked to volume, so they frequently climb when there is a lot of it and fall when there isn’t.

9) Commitment of Traders: This COT report measures the net position held by commercial participants (those who buy and sell for their own accounts) as well as smaller “non-reportable” traders including huge businesses, governments, and investment managers. A high degree of commercial activity might indicate that a trend shift is on the horizon.

10) Sentiment Indicators: These include both market sentiment polls and technical analysis sentiment research. Some technicians, for example, utilize sentiment research to identify whether a stock is overbought or oversold.

Even though the price has dropped, if more people are positive than bearish on a stock, it’s generally not a good time to sell. If on the other side, there are more bearish than bullish folks, it may be a good time to purchase.

These were some useful tips on price action patterns and techniques. Finlearn Academy is the best initiative for those who want to study the stock market in deeper ways,

Isaiminia World Breaking News & Top Stories

Isaiminia World Breaking News & Top Stories