People with bad credit often find it difficult to get approved for a personal loan. However, there are still a few ways to get personal loans for bad credit. One way to get a personal loan with bad credit is to apply for a loan through a credit union. Credit unions are often more forgiving when it comes to bad credit, and they may be more likely to approve a loan application.

Another way to get a personal loan with bad credit is to apply for a loan through a peer-to-peer lender. Peer-to-peer lenders are online platforms that connect borrowers with individual lenders. These lenders may be more likely to approve a loan application if the borrower has bad credit.

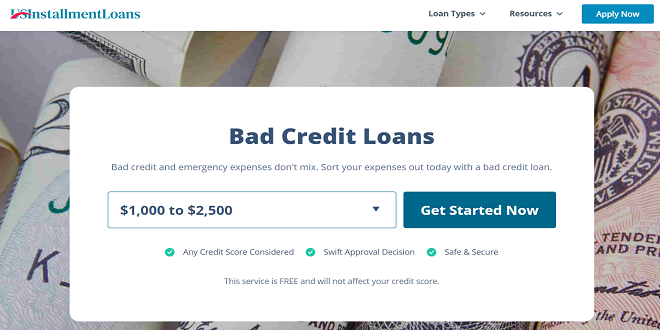

Finally, a third way to get a personal loan with bad credit is to apply for a loan through a payday lender on US Installment Loans. Payday lenders are the last resort for borrowers who have bad credit and need money quickly. However, payday loans come with high interest rates and fees, so it is important to read the terms and conditions carefully before applying.

No matter which route you choose, it is important to be prepared and to have all of your documents ready. This will help to ensure a smooth application process.

Am I Eligible for a Personal Loan With Bad Credit?

When it comes to borrowing money, your credit score is one of the most important factors that lenders will consider. A bad credit score can make it difficult – if not impossible – to get a personal loan. But is there any way to get a personal loan with bad credit?

Yes. For instance, if you are unable to get a personal loan from a traditional lender, you may want to consider a payday loan from US Installment Loans. Payday loans are small, short-term loans that are typically available to people with bad credit. However, the interest rates on payday loans are high, and you will be required to pay back the loan in a short amount of time.

If you are considering a payday loan, be sure to read the small print carefully. You don’t want to get stuck in a cycle of debt where you are continually borrowing money to pay back previous loans.

You should also keep in mind that some lenders may require you to put up collateral in order to secure a bad credit loan. It is for this reason that you will need to shop around for the best interest rate and lending terms. There are also a number of credit unions that offer personal loans to their members.

What Types of Personal Loans Can I Get With Bad Credit?

If you’re looking for a personal loan but have bad credit, you may be wondering what options are available to you. Here’s a look at some of the different types of personal loans you may be able to get with bad credit.

Unsecured Personal Loans

An unsecured personal loan from US Installment Loans is a loan that doesn’t require you to put up any collateral. This type of loan is typically available to borrowers with good or excellent credit, but there are a few lenders that offer unsecured loans to borrowers with bad credit. However, the interest rates on unsecured loans for bad credit borrowers are typically higher than for borrowers with good credit.

Secured Personal Loans

A secured personal loan is a loan that’s backed by collateral. This type of loan is typically available to borrowers with bad or poor credit. The interest rates on secured loans are usually lower than on unsecured loans, and the loan terms may be more favorable. However, if you fail to make your payments, the lender can seize the collateral.

Personal Line of Credit

A personal line of credit is a type of loan that works like a credit card. You can borrow money as needed and only pay interest on the amount you borrow. A personal line of credit is a good option for borrowers with bad credit because it doesn’t require a credit check and has a low interest rate.

Peer-to-Peer Loans

Peer-to-peer loans are loans that are funded by individual investors rather than by banks or other traditional lenders. Peer-to-peer loans are available to borrowers with all types of credit, and the interest rates are usually lower than those on traditional loans.

Where Can I Borrow a Personal Loan With Bad Credit?

If you’re looking for a personal loan but have bad credit, you may be feeling a bit stuck. It can be tough to find a lender who will work with you, especially if your credit score is below 600. However, there are still options available to you.

One option is to look into peer-to-peer lending. With peer-to-peer lending, you borrow money from individual lenders rather than a bank. This can be a good option if you have bad credit because there are many lenders who are willing to work with borrowers who have a lower credit score.

Another option is to look into microlending. Microlenders are organizations that offer small loans to people who may not be able to get a loan from a bank. This can be a good option if you need a small loan for a specific purpose, such as a car repair or a medical bill.

If you’re still having trouble finding a personal loan with bad credit, you may want to consider a secured loan from US Installment Loans. A secured loan is a loan that is backed by collateral, such as your home or your car. This can be a good option if you need a larger loan and you’re not able to get a loan from a bank.

No matter what option you choose, be sure to do your research and compare interest rates and terms from different lenders. By shopping around, you may be able to find a personal loan that fits your needs and your budget.

When Are Personal Loans for Bad Credit Due?

There is no definitive answer to the question of when personal loans for bad credit are due. The terms of the loan agreement will dictate the specific due date. However, most personal loans for bad credit will be due within a year of the loan being issued.

There are a few things to keep in mind when it comes to personal loans for bad credit and their due date. First, be sure to read the loan agreement carefully to make sure that you understand the terms and conditions. Second, be sure to make timely payments so that you don’t incur any late fees or penalties.

If you are having difficulty making payments on your personal loan for bad credit, be sure to reach out to your lender as soon as possible. They may be able to work with you to create a payment plan that works for your budget. Failing to make payments on your loan can result in negative marks on your credit score, so it’s important to take action if you’re having trouble.

Isaiminia World Breaking News & Top Stories

Isaiminia World Breaking News & Top Stories